Marginal Tax Bracket 2025. You always owed federal income tax on interest from savings accounts. Under albanese’s changes, the 37 per cent tax rate will be retained for income between $135,000 and $190,000, the 19 per cent rate on income between $18,200 and $45,000.

2025 tax rates for a single taxpayer for a single taxpayer, the rates are: You pay the higher rate only on the part that’s in the new tax bracket.

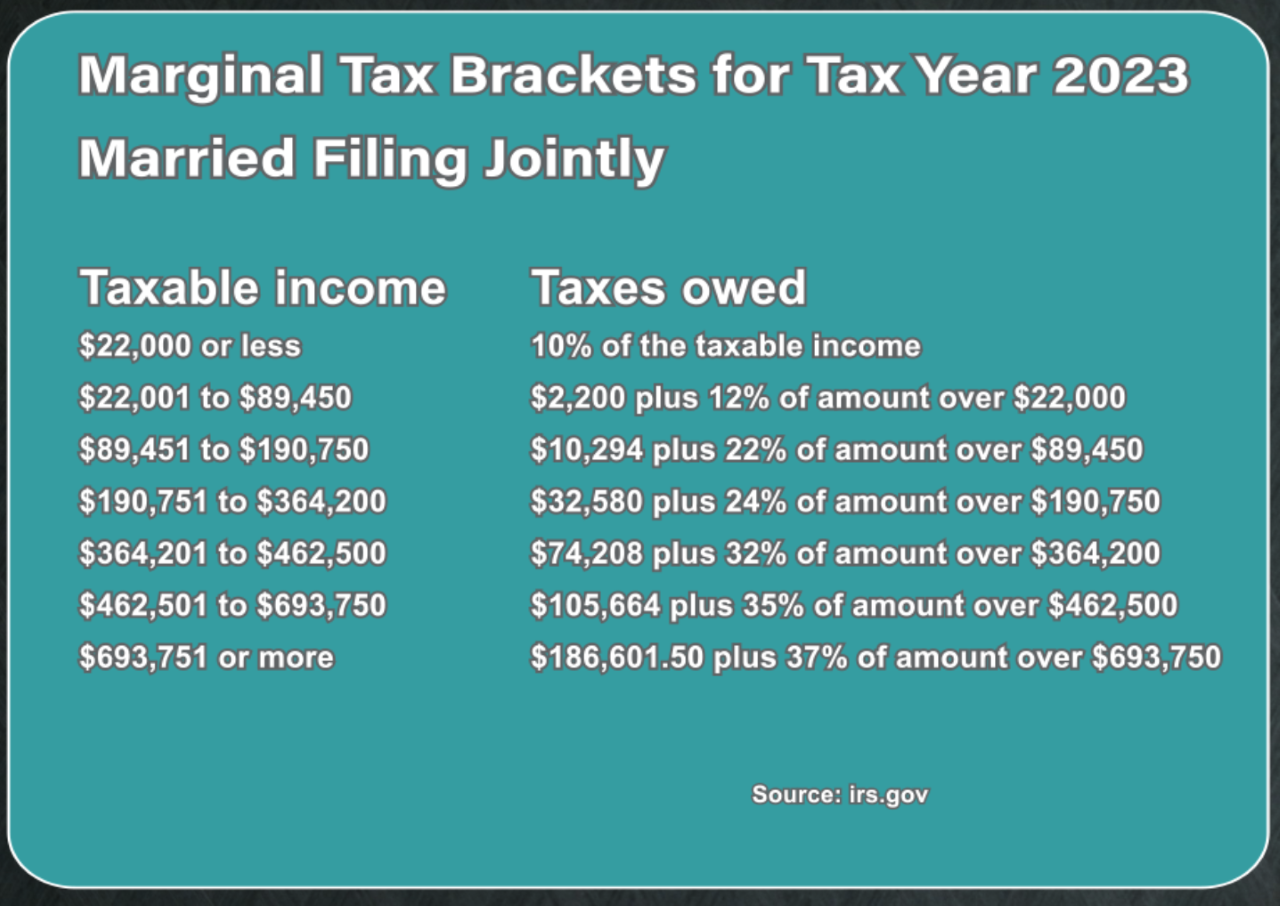

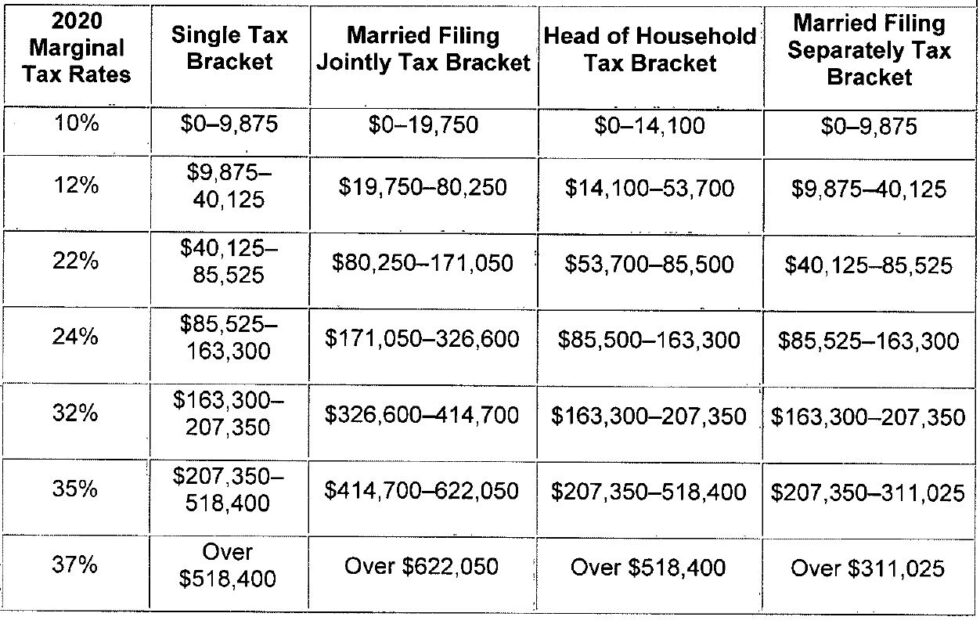

The marginal tax rate is the percentage at which your next dollar of income is taxed, reflecting how income tiers affect your tax obligations.

Explainer What are tax brackets and marginal rates? Canadians for, At the college investor, we want to help you navigate your finances. An australian resident for tax purposes for the full year.

Us federal tax brackets 2025 vaultseka, Nov 13, 2025, 6:12 am pst. This is done to account for inflation.

Marginal Tax Rates StreetFins®, Then you would pay 12% on the remaining $10 for $1.20 in tax. This is done to account for inflation.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, You pay the higher rate only on the part that's in the new tax bracket. Provincial and territorial tax rates vary across canada;

Complete Guide to Canadian Marginal Tax Rates in 2025 Kalfa Law, The irs has announced its 2025 inflation adjustments. Nov 13, 2025, 6:12 am pst.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, However, your provincial or territorial income tax (except quebec) is calculated in the same way as your federal income tax. This is done to account for inflation.

2025 Marginal Tax Rates Chart Hot Sex Picture, You pay the higher rate only on the part that's in the new tax bracket. Published 6:00 am edt, wed february 21, 2025.

Federal Tax Earnings Brackets For 2025 And 2025 Investor Insights 360, David tony, cnn underscored money. You pay the higher rate only on the part that's in the new tax bracket.

Tax filers can keep more money in 2025 as IRS shifts brackets Andrews, Nov 13, 2025, 6:12 am pst. Then you would pay 12% on the remaining $10 for $1.20 in tax.

IRS Tax Brackets AND Standard Deductions Increased for 2025, Under albanese’s changes, the 37 per cent tax rate will be retained for income between $135,000 and $190,000, the 19 per cent rate on income between $18,200 and $45,000. 14 rows see enhanced basic personal amount.